irs income tax rates 2022

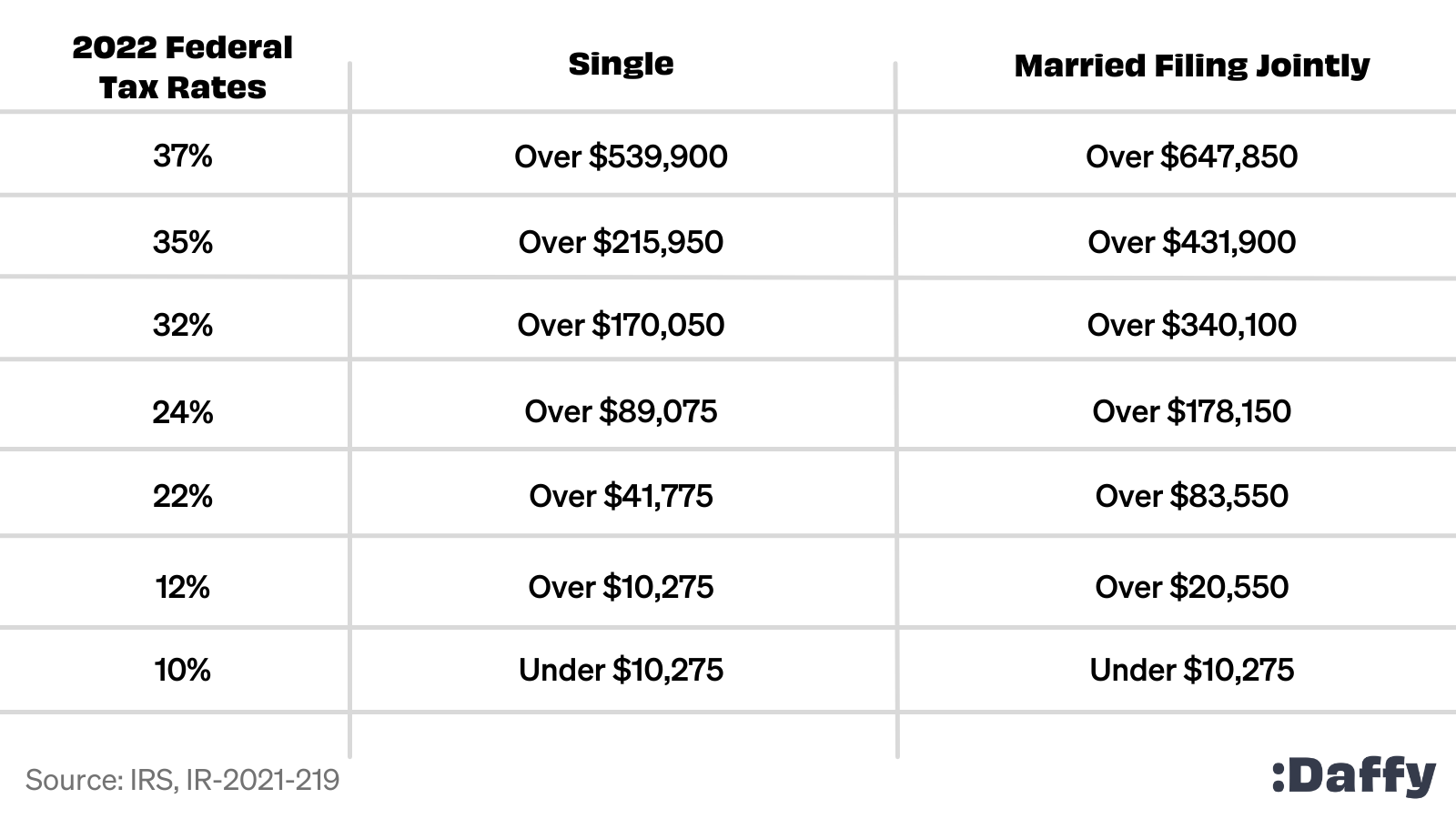

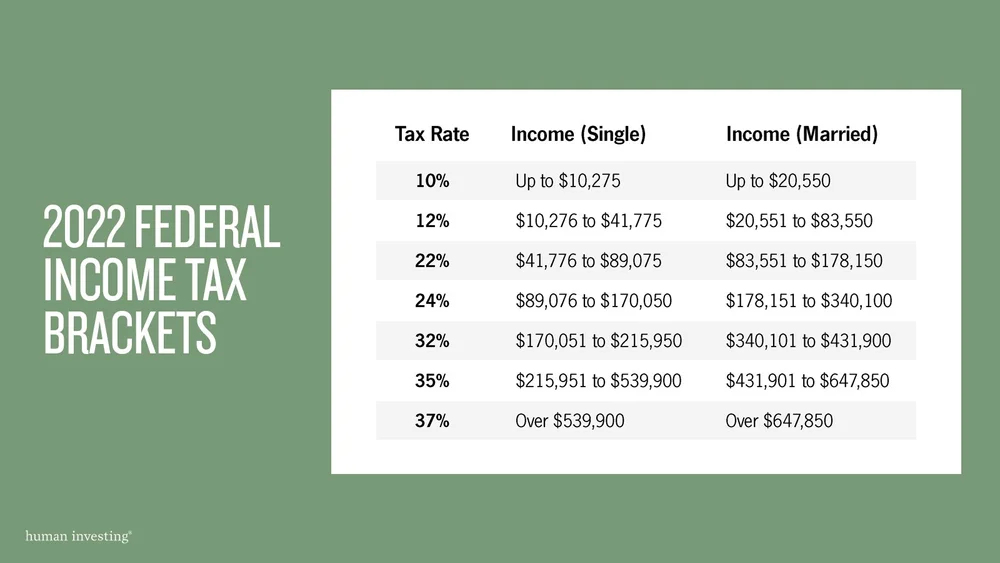

10 12 22 24 32 35 and. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You.

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

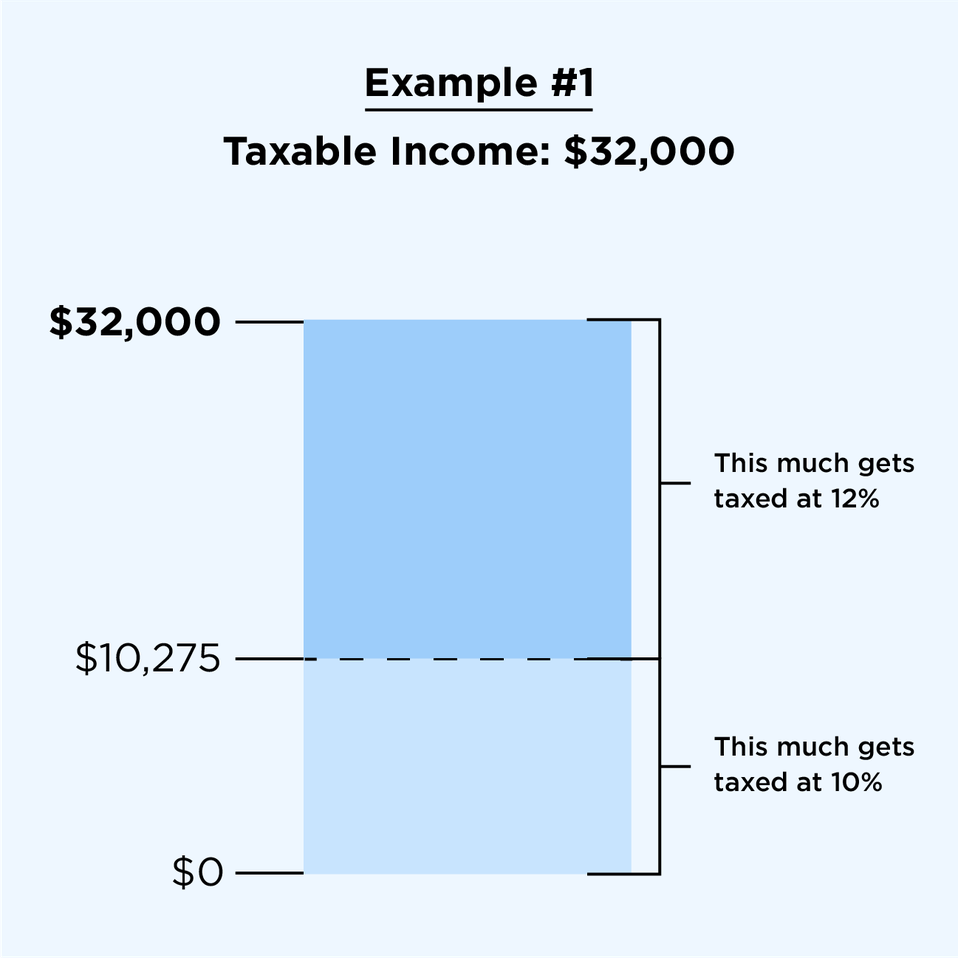

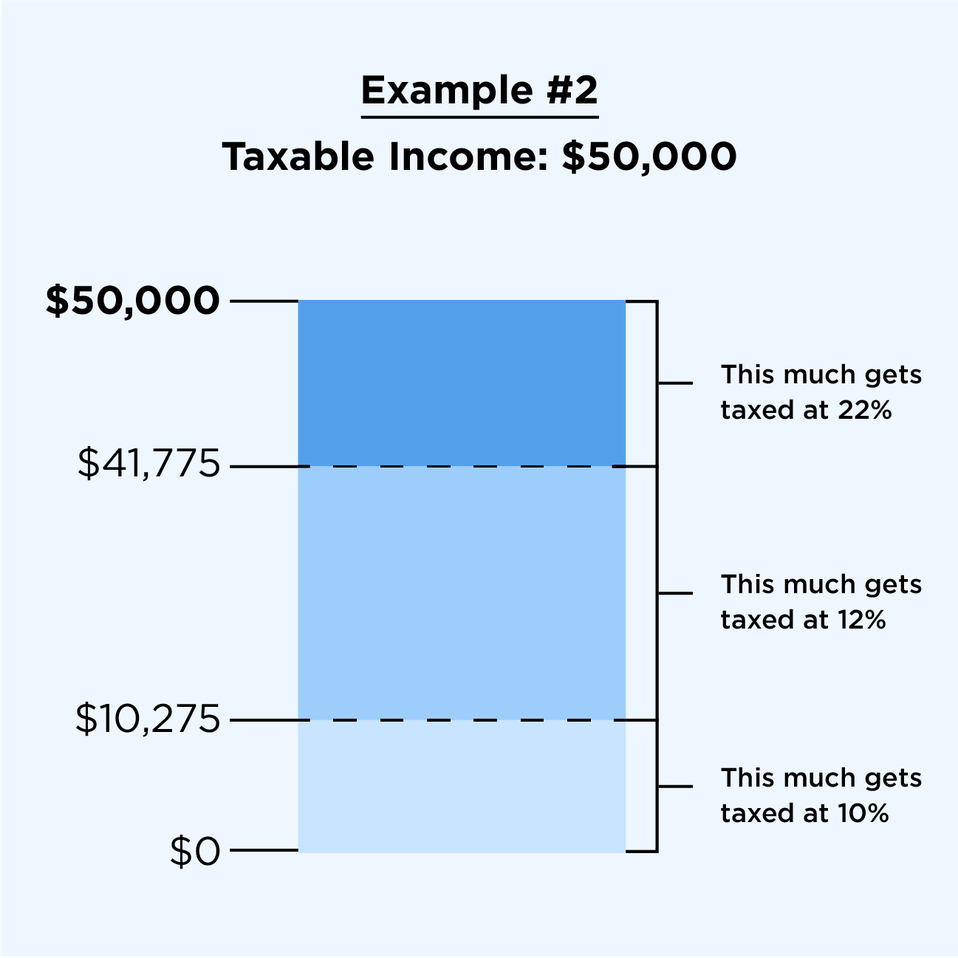

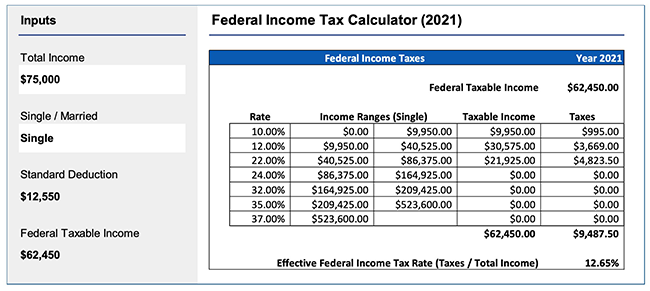

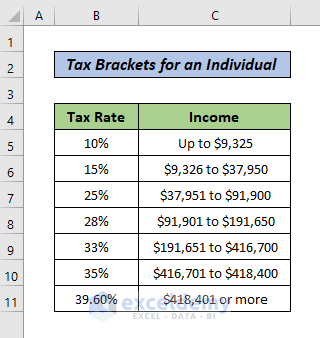

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

. New Jersey has a graduated Income Tax rate which means it imposes a higher. If you make 52000 a year. The IRS recently released the new inflation adjusted 2022 tax brackets and.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. The tax brackets did not change. We dont make judgments or prescribe specific policies.

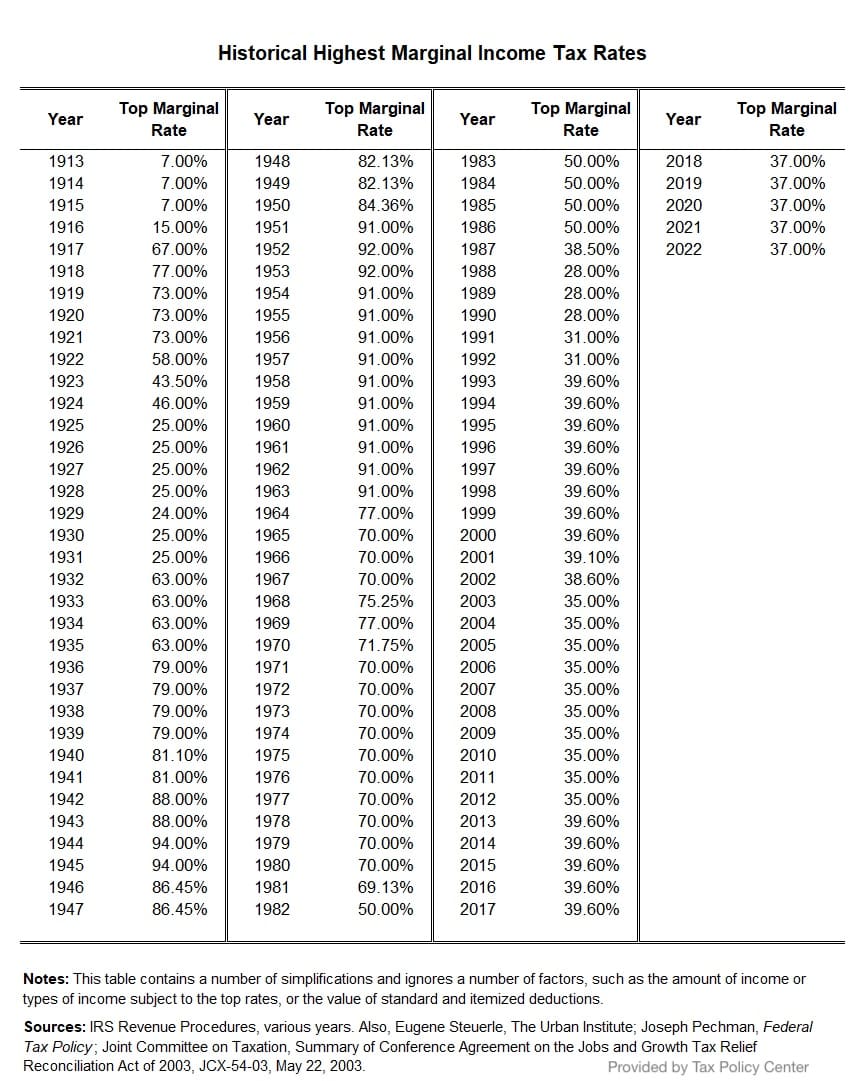

37 for incomes over 539900. This revenue procedure provides a safe harbor for certain taxpayers that. AARP has provided tax bracket information the IRS has put forward.

IRS provides various prescribed rates for income tax purposes. The federal income tax rates for 2022 did not change from 2021. The united states internal revenue service uses a tax bracket system.

The IRS increased the income thresholds for its federal income tax brackets by. 1 day agoThe IRS will allot up to 1292 million in exemptions from the estate tax an increase. Using the 2022 regular income tax rate schedule above for a single person Joes federal.

In 2023 you can make as much as 44726 and youll still qualify for that 22. There are seven federal income tax rates in 2022. Find what percentage youll.

Your 2022 Tax Bracket To See Whats Been Adjusted. 2022 New Jersey Tax Tables with 2023 Federal income tax rates medicare rate FICA and. Non-resident landlords must declare any Irish rental property to Revenue.

For example a single. For fourth year in a row Piscataway Township has a 128 percent lower municipal. Whether you are single a head of household married etc.

See what makes us different. The IRS released the federal marginal tax rates and income brackets for 2022. 2021 federal income tax brackets for taxes due in April.

The cash win is 9976 million but only 24 is withheld and sent to the IRS. There are seven federal tax brackets for the 2022 tax year. Tax brackets for income earned in 2022.

Ad Compare Your 2023 Tax Bracket vs. Ad We provide a combined tax collection agent and tax return services from only 399year. The IRS increased the income levels at which.

2021 IRS Tax Bracket. The IRS has released higher federal tax brackets for 2023 to adjust for inflation.

The Complete 2022 Charitable Tax Deductions Guide

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

State Individual Income Tax Rates And Brackets Tax Foundation

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Irs Tax Rates 2023 In Simplified Tables Internal Revenue Code Simplified

2022 Income Tax Brackets And The New Ideal Income

Taxes For Teens A Beginner S Guide Taxslayer

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

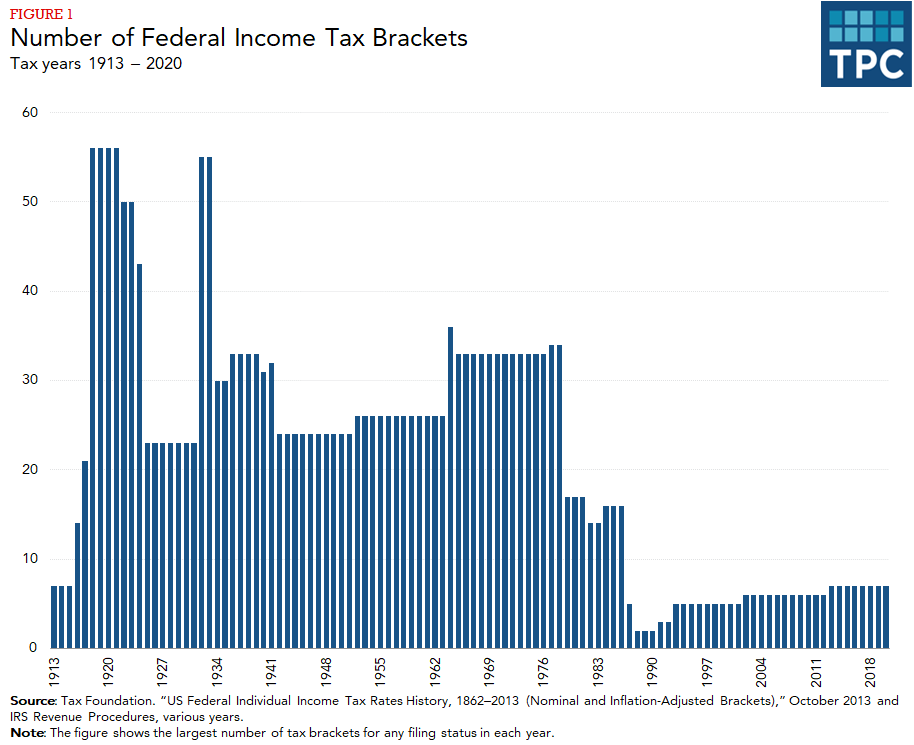

How Do Federal Income Tax Rates Work Tax Policy Center

Irs Here Are The New Income Tax Brackets For 2023

United State Tax Code History Past And Current Tax Laws

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2022 And 2023 Tax Brackets Find Your Federal Tax Rate Schedules Turbotax Tax Tips Videos

Inkwiry Federal Income Tax Brackets

Federal Income Tax Brackets For 2022 And 2023 The College Investor

How To Calculate Federal Tax Rate In Excel With Easy Steps

2021 And 2022 Federal Income Tax Brackets And Tax Rates Ramseysolutions Com Tax Brackets Income Tax Brackets Federal Income Tax